You may have heard about the government Help to Buy scheme and wondered if it might apply to you. Our team of experts have looked into it thoroughly and the good news is that at the moment, equity loans are available to first-time buyers as well as homeowners looking to move. The home you want to buy must be newly built with a price tag of up to £600,000. So how does it work?

The Help-to-Buy ISA has been closed to new applicants since 2019, but this popular home-buying resource – the Help-to-Buy equity loan scheme, has an end date of March 2023.

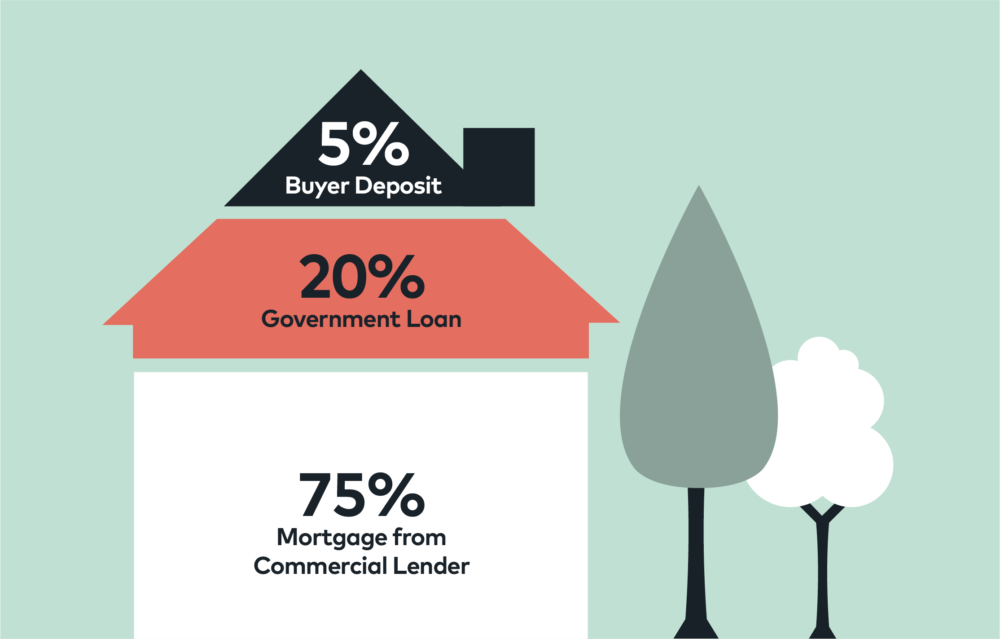

Help to Buy is a Government backed scheme available across England that allows first time buyers and existing homeowners to buy a home with just 5% deposit.

The scheme was devised to help people with decent incomes who were struggling to save a big deposit to get onto the property ladder.

To date it has been available for existing homeowners as well as first-time buyers, but from 2021 only first-time buyers will be able to use it.

The 2021 change will also see regional value caps being introduced. This means that the scheme will only be usable for homes below a certain price, and this ceiling price will vary from region to region. If you’re considering Help to Buy, it’s also worth looking at shared ownership to help you get on the property ladder.

Help to Buy is now over seven years old, and those who used the scheme within its first year are likely to have done pretty well out of it! London houses shot up by more than 50 percent after 2013, so it’s likely that early adopters will have made a good chunk of profit.

You would receive an equity loan of up to 20 per cent of the cost of a new home. The terms of Help to Buy do vary, so take a look at the different schemes here https://www.helptobuy.gov.uk/

The money is interest-free for five years. In exchange, the Government takes a share of your property and in any price uplift.

You need to raise a five percent cash deposit (half the minimum deposit normally required) and cover the remainder via a mortgage. It may still be a stretch but it certainly makes home ownership much more doable than going it alone.

The good news is Help to Buy loans are interest free for the first five years and designed to help first-time buyers save a bigger house deposit, but what do you need to know about paying back?

Just to reiterate here that the Help to Buy scheme does mean the Government has a stake in your home and, after five years, will want you to pay it back – it will add interest until you do. For some this payback will hurt. The Government will have invested in your home – so if your house price goes up, so does the amount that you need to pay back.

Not everyone will mourn the passing of the Help-to-Buy scheme. One of the main criticisms it has attracted is that it has artificially inflated the prices of new homes, so that the main beneficiaries have been the house builders.

We at Chosen would summarise the whole scheme as follows:

The idea is that you don’t pay interest for the first five years, as we are guessing the Government is banking on house prices rising sufficiently for you to be able to refinance or remortgage the property to release equity to pay the Government back. However, if you can’t, they will just start charging you interest at commercial rates – so bear this in mind before committing.

Our team of experts can see the pros and cons of this scheme – our advice is to invest wisely and you could do well out of it.

For further info visit https://www.helptobuy.gov.uk/ or chat to one of our experts.